Do You Have Nexus in Ohio?

The two main ways to establish sales tax nexus are physical nexus and economic nexus. Physical nexus is established when a business has a type of physical presence in a state, such as a store or warehouse. Economic nexus, on the other hand, is established based on a business’s sales activity in a state, regardless of whether they have a physical presence or not. This means that even if a business doesn’t have a physical presence in a state, they may still be required to collect and remit sales tax if they meet the economic nexus threshold in that state.

Ohio requires businesses to collect and remit sales tax in the state if they have a physical presence within its borders. This physical presence can be established through various factors, such as having a physical storefront, office, warehouse, or employees who work in Ohio. In addition, businesses that make sales to Ohio customers from outside the state may also be subject to sales tax if they meet certain economic thresholds. Once a business has established physical nexus in Ohio, they must register with the Ohio Department of Taxation, collect and remit the appropriate amount of sales tax, and file regular sales tax returns. To ensure compliance with state sales tax laws, businesses should be aware of the specific requirements for physical nexus in Ohio. If you would like to speak to someone about your specific sales tax nexus footprint, schedule a call with a HOST representative today.

Ohio economic nexus refers to the legal obligation of businesses to collect and remit sales tax in Ohio based on their economic activity within the state. In June 2018, Ohio enacted a law that requires remote sellers to collect and remit sales tax on sales made to Ohio customers if they exceed certain sales thresholds. Currently, businesses are required to collect and remit Ohio sales tax if they have over $100,000 in gross receipts from Ohio customers or engage in at least 200 transactions with Ohio customers annually. This means that even if a business does not have a physical presence in Ohio, they may still be required to collect and remit sales tax based on their economic activity within the state. Businesses should be aware of the Ohio economic nexus rules and comply with them to avoid penalties and legal issues.

How Do You Register For a Sales Tax Permit in Ohio?

In order to obtain a sales tax permit in OH, follow the steps below.

- Navigate to the Ohio Business Gateway Portal.

- Click “Log In”.

- Click “Create Account”

- Set up your OH gateway profile. This requires that you retreive a PIN that will be sent to the email address provided.

- Once you set up your profile, log in and proceed forward through the questionnaire.

After your sales tax application has been processed by the state, you will be issued a sales tax permit. You can then start collecting and remitting sales tax to the state by submitting your sales tax returns.

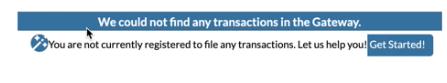

TIP: At a certain point in the application, you will be faced with the screen below. You must select “Get Started” to actually kick off the sales tax application process.

What Information Do You Need to Register?

Some of the information that you will need readily available register for a sales tax permit in OH are below:

- Business name and address

- Business entity type (e.g. sole proprietorship, partnership, LLC, corporation)

- Federal employer identification number (FEIN) or social security number (SSN)

- Business activity information, including a brief description of your products or services

- Estimated monthly/annual sales volume

- Banking information for electronic funds transfer (EFT) of sales tax payments (optional)

- Sales tax jurisdiction information for each location where you will be collecting and remitting sales tax

- Contact information for the business owner or authorized representative

- The effective date of when your business established nexus in the state

While filling out the application, make sure to periodically save it as a draft to avoid losing your progress. Once the application is complete and submitted, it is crucial to save a copy for your records. If you are audited in the future, you will need to be able to reference this initial documentation.

How Long Does it Take for the State to Process Your Sales Tax Registration?

The length of time it may take the state to process a sales tax permit application in Ohio can vary depending on several factors such as the quantity of applications being processed by the state at that time and the completeness of the application submitted. Any missing or incorrect information can cause delays and lengthen the time it takes to process your application.

However, Ohio is one of the few states that most often immediately provides you with your sales tax account ID as well as access to your online filing account. If this is not the case, consider calling the state to see if the application was submitted successfully.

Need Assistance Registering?

If you encounter any difficulties while submitting your application, you can reach out to the state via email or by calling 888–405–4039 Alternatively, for a hassle-free option, HOST provides a sales tax registration service that includes online account setup and complete registration assistance. Completing a simple form is all it takes, and we’ll take care of the rest for you.

Ready To Start the Sales Tax Registration Process?