As an e-commerce retailer, sooner or later you will encounter a resale certificate. Most of the time you’ll be providing your resale certificate to your vendor in order to buy items to resell.

But you’ll also sometimes find yourself on the other end of that transaction, where a buyer presents you with a resale certificate in order to buy your products to resell.

This article details everything you need to know about resale certificates, from when and how to use them, to when and how to accept them, and how to avoid any resale certificate pitfalls.

What are resale certificates?

Resale certificates provide verification that a buyer intends to buy items tax-free in order to either resell them or use them as parts or ingredients in creating items to resell.

Since each of the forty-six states (and Washington DC) that have a sales tax make their own sales tax rules and regulations, how resale certificates work varies by state. In most cases, your resale certificate number is the same as your state sales tax registration number.

Some states will give you a resale certificate to print out and present to your vendor, but in most cases as long as you provide all the required information to your vendor, you can provide it in any form. You can find printable resale certificates online, or even in packs at an office supply store.

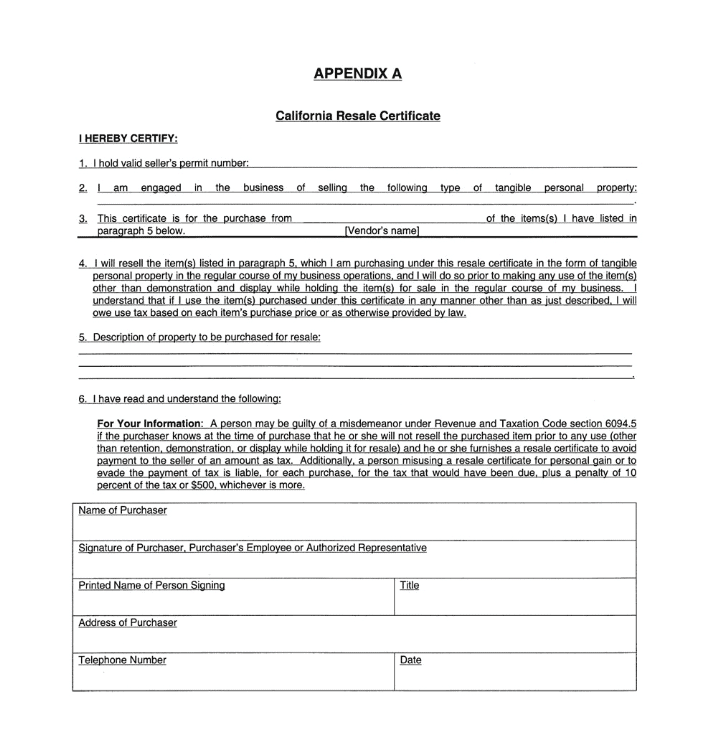

Here’s an example California resale certificate.

How to Use a Resale Certificate

When making a purchase of items to resell, your vendor will require that you provide them with certain identifying information in order to make the sale. This information includes:

- Your name

- Your business name

- Your sales tax registration number (the format and what his is called varies by state)

- Your address

- The items you are purchasing and your intended use

- Your signature

Since the onus is generally on the retailer to ensure that they are making a legal tax-free sale, they may be very careful when accepting your resale certificate, and may even require more information from you.

For that reason, it’s important to note that resale certificates are only to be used for buying goods to resell or buying the ingredients to produce goods to resell.

An example would be buying a pallet of toothpaste from a toothpaste supplier to sell at your dental office. Or, buying cloth and thread in order to turn those into sassy embroidered sayings to sell as home decor on Etsy.

Resale certificates do not apply to items you intend to use in the normal course of your business, like coffee for the employee breakroom or printer paper.

If you do business with a vendor, they may keep your resale certificate on file. However, they’ll often require that you update it periodically so they can be sure their records are current.

Vendors are also allowed to refuse to accept your resale certificate. In this case, you can try to find another vendor, or keep track of the tax you paid on goods you intended to resale and request a refund on your next sales tax return.

If you have questions about using resale certificates, you can contact us for assistance.

How to Accept a Resale Certificate

If you mainly sell goods at retail, you may not often have to deal with resale certificates.

But you should still familiarize yourself with accepting resale certificates, because as a retailer, it’s your responsibility to ensure that any resale certificates you accept are complete and accurate. Unfortunately, if you accidentally make an invalid tax-free sale, it is generally your responsibility to pay the taxes you didn’t collect.

If a buyer presents you with a resale certificate, do the following:

- Ensure it’s completely and accurately filled out according to your state’s guidelines for resale certificates. This generally means buyer’s name, company name, sales tax registration number (and state where they are registered if not local), the items they are buying, the purpose of those items and the buyer’s signature

- Ensure that you are able to accept the resale certificate. While most states allow retailers to accept out-of-state resale certificates, ten states do not. (These are listed below.)

- Check that the intended purpose for the items makes sense. If they are a tractor manufacturer and are trying to buy printer paper, coffee and pencils tax free, this should raise a red flag. It’s unlikely they’ll use these office supplies as components in the manufacture of tractors

- Verify the resale certificate – In many states, you can simply enter a resale certificate number at the state’s database to ensure that your customer’s sales tax number is valid and that the business is in good standing

- Keep the resale certificate on file. In case of an audit, you’ll want to have your resale certificates handy. If you make a tax-free sale but don’t have the proof to back it up, you may find yourself owing those taxes after an audit, even if the sale was valid

Further, you may live in one of the ten states that does not allow vendors to accept out-of-state resale certificates.

Ten States That Don’t Allow Accepting Out-of-State Resale Certificates

- Alabama

- California

- Florida

- Hawaii

- Illinois

- Louisiana

- Maryland

- Massachusetts

- Washington

- Washington DC

If you live or make sales out of one of these states, be careful to abide by state rules.

For example, if you are a retailer located in Massachusetts and a buyer tries to use a Kansas resale certificate to purchase goods from you, you are, unfortunately, not allowed to accept that tax free sale.

Resale Certificates: Frequently Asked Questions

Should I register in a new state simply to buy items tax free?

As with many sales tax questions, it depends. Registering in a new state requires that you collect sales tax from all buyers in that state and periodically file sales tax returns to that state. Further, only about 10 states don’t accept out-of-state resale certificates. But, in cases where your major wholesale vendors are located in one of those states and won’t accept your resale certificate, you might consider registering in that state. We recommend consulting with us before you make a decision.

What do I do if a vendor won’t accept my resale certificate?

Some vendors simply don’t accept resale certificates. Perhaps they want to be the exclusive vendor for their item, or perhaps they had questions about the validity of the information presented. If a vendor validates a resale certificate erroneously, they are on the hook to pay back any uncollected sales tax, so they can be overly cautious.

One option, of course, is simply to find another vendor for the same item. But if that isn’t viable, you can also pay the sales tax and then try to receive a credit on your next sales tax return. The only issue there is that you are generally required to be registered to collect sales tax in the state where the sale takes place. In this case, it’s up to you to weigh the financial burden of paying sales tax on goods for resale against the administrative headache of registering to file and collect sales tax in a new state.

We’re happy to help you with this decision. Sign up for a HOST sales tax consult today.

I haven’t been accepting or updating resale certificates for my tax-free sales. What should I do?

During an audit, one of the first things an auditor will look at is transactions where you did not charge sales tax.

Because of that, if you sell goods for resale to other retailers, it is vital that you keep a record of any tax free sales you make on otherwise taxable products. Even if the sale was totally legal and made in good faith, if it isn’t documented you may be responsible for reimbursing the state for unpaid tax. Ouch!

If you haven’t been keeping resale certificates, or haven’t been updating the retails certificates provided by your long term customers, we recommend contacting your customers and getting up to date on this necessary paperwork without delay.